TRKR:NIQ Brand Growth Snapshot. Savoury Snacks, July ‘25

For every brand owner, the key to unlocking brand growth is getting more shoppers to buy them, as championed by Byron Sharp in ‘How Brands Grow’

59% of the top 3,000 grocery brands have grown through penetration.

Each month our TRKR:NIQ Brand Growth Snapshot series will focus on identifying the brands that are leading the way in their respective categories. We’ll also look at what impact this has had upon their category. Have they grown by stealing spend from rival brands (creating churn) or have they added incremental growth?

With our help, FMCG brand owners will be able to look both inside and outside their categories to identify examples of growth brands they can take learnings from.

Our data is sourced from NIQ’s 30,000 GB household panel. NielsenIQ (NIQ) is the global leading consumer intelligence company, providing comprehensive market research and consumer insights. They offer detailed data on consumer behaviour, market trends, and industry performance, helping businesses make informed decisions.

TRKR work closely with the UK Small & Medium Business Team, who are passionate about giving challenger brands the best data, insights and knowledge to compete with the biggest players across the FMCG landscape!

Together we provide products, services and most importantly prices specifically for start ups and small/medium businesses!

Savoury Snacks is a category worth £5.4 billion in the UK, with the grocery multiples accounting for 85% of spend and 80% of volume sold.

It is dominated by huge crisp brands such as Walkers, Pringles and Doritos but also includes popcorn, nuts and other savoury snack options.

With consumer tastes evolving and focusing on healthier options, protein, free from and premium, the category has plenty of room for innovation. Newcomers in recent years have included the likes of Love Corn and Graze in the health sector, and in 2024 Cheez It launched with a bang (and 4.4m shoppers)

The key objective for Retail Buyers is finding new options that grow the category, rather than stealing from existing brands

For the 52 weeks to June 25, the Savoury Snack brand purchased by the most shoppers in GB is “standard” Walkers Crisps, purchased by 60% of households. That’s a whopping 17.6 million homes across GB!

Interesting to also see Aldi Snackrite and Lidl in the top 15 GB brands, which demonstrates the continued growth of the discounters.

Walkers Sensations are also worth a mention - Thai Sweet Chilli is the largest premium sharing bag (150g) product in GB, with a Unit Rate of Sale of 35 (units sold per store per week) within the major multiples

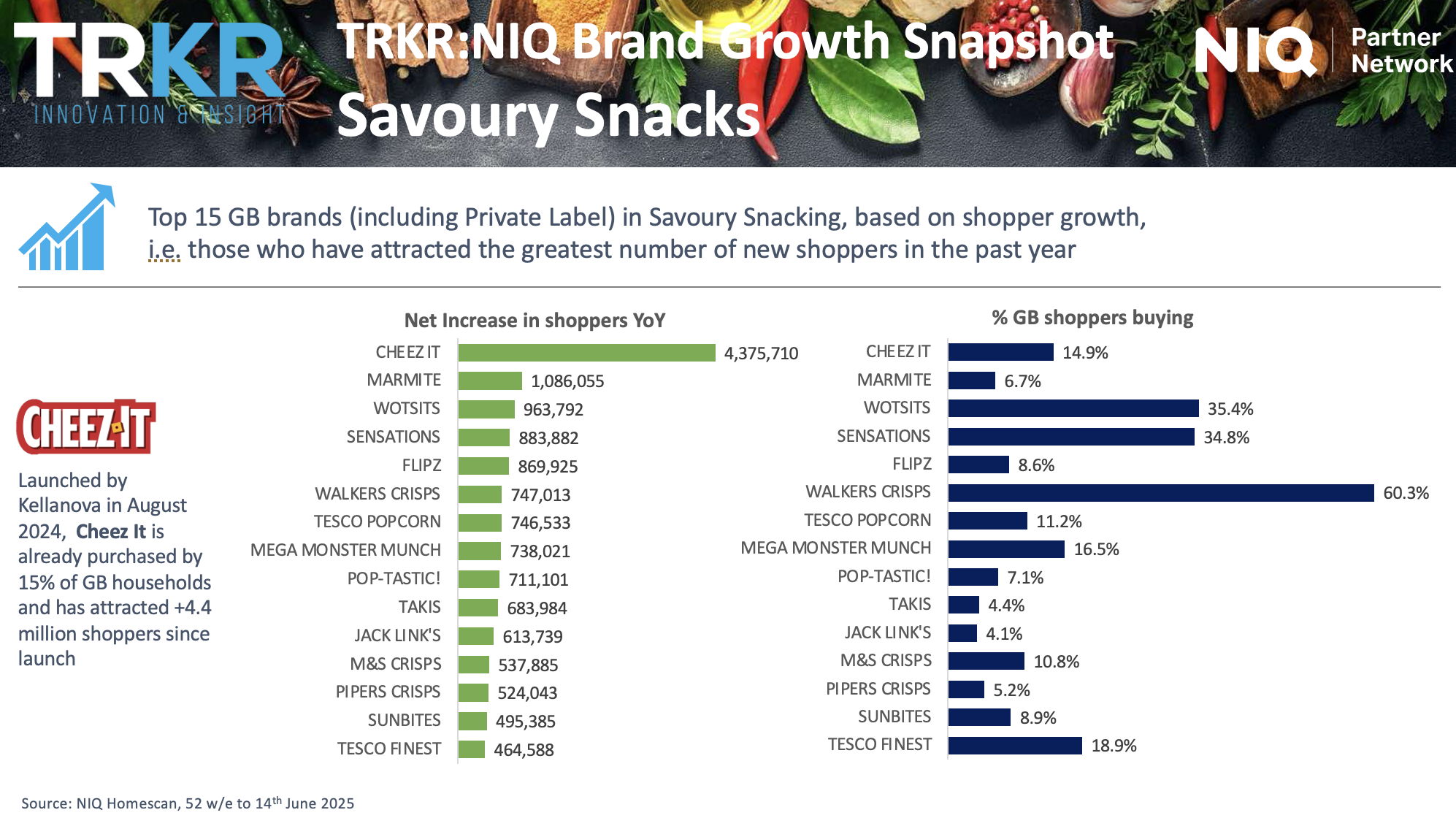

Within the category we can identify which brands have gained the most additional shoppers over the past year, then try to understand more about how those brands have achieved this penetration growth. The benefit for other brand owners is to apply potential learnings to their own brands.

While Cheez It (a new UK product launch from a global brand) has achieved the biggest net gain in shoppers over the past year, we should also look at the progress of retailer Own Label.

M&S Crisps are purchased by 1 in 10 GB households and they have gained an additional 537,885 shoppers over the last year. There are two factors that have helped to contribute towards this. Firstly NPD, with the recent launch of their Extreme Ridge Crisps range, supplied by Taylors Snacks. Secondly, M&S are recognised as providing more space in store for the Savoury Snacks as a category per square footage versus other retailers.

It’s one thing to grow shopper numbers, but to be able to do that without cannibalising category growth is what retail buyers are ultimately trying to achieve when listing new products.

Pipers Crisps are a great example of incremental sales within the snacking category, with 67% of their growth driven by shoppers adding Pipers to their existing brand repertoire, rather than switching to Pipers from rival brands.

TAKIS, on the flip side, has seen over have of their growth in spend come from shoppers switching into TAKIS from rival brands.

In summary….

For individual brands, growth comes from gaining new shoppers. However, for the Category and for retail buyers, success is brands achieving this by growing the category at the same time. By understanding these shopper dynamics, brand owners can focus on the best examples of incremental brand growth, which they may then try to replicate. Those brands will be more likely to retain and grow shelf presence and distribution.

What next?

We (you) can use NIQ’s Panel data to identify what is driving the growth (or decline) of your own brand and products, and of rival brands in your category.

In addition to switching and incremental sales, other useful measures within Panel include:

Penetration - the % of GB households who are buying a brand over a given time period

Shopper conversion - for example, the % of Sainsbury’s Savoury Snack shoppers who are buying Walkers Multipack Crisps

Spend per household - the average spend on a category/sector/brand (or in any retailer) over a given time period

TRKR have years of experience in combining Panel data with EPOS data and bespoke shopper insight, to create compelling Retail Buyer pitches for our clients. Not just in Snacking, but across most FMCG categories. To discuss the opportunities for your own company, get in touch with Mark@TRKR.co.uk