Can Insight really grow brands?

How many SMBs invest in shopper Insight? Very few in our experience.

For most, market data (EPOS and PANEL) is the extent of their investment, and many struggle to get the full value even from that.

Of course, market data is a must-have for that Buyer discussion if you want to win or maintain shelf space in the Mults.

But shopper insight? A cost too far maybe, at a time when the bottom line is still being squeezed by rising costs.

To be persuaded to invest in insight, businesses need to understand the potential return on that investment.

On TRKR’s recent webinar, Kantar Worldpanel did a great job of demonstrating the potential impact of shopper insight.

What generates growth?

Growth is generated by new shoppers, increased penetration, rather than more sales from existing shoppers. But it’s not easy, only 30% of the Top 250 brands increased penetration in 2024 (source: Kantar)

Clearly these are challenging times – how can you grow penetration when the Mults are rationalising their listings, many categories are flat-lining or in decline, and with the continued challenge from private label?

To win and keep listings your products need to have a higher-than-average rate of sale, and to add incremental value to the Buyer’s category.

How can you increase rate of sale?

Outside of promotions, why would shoppers buy your product?

Firstly, your products need to be a better alternative than the other options available – a true Value Proposition.

To have a true value proposition, your products need to satisfy a shopper’s needs better than those alternatives.

How do you do this?

Well firstly you need to know who your shoppers are going to be, who you’re targeting.

Next you need to understand their needs, what they value, and where those needs aren’t being satisfied.

There’s literally only one way to find these out – shopper insight

Barriers to Insight?

The cost obviously, but if the insight could unlock growth it would be worth the investment. Another barrier may a lack of confidence that the insight can really generate growth.

To prove the point, Kantar provided a great case study…

Haribo...

Haribo added 900k shoppers in 2024 and 47% value over 2 years

Did they do this by attracting more young people and parents of small kids to the brand? Wrong - they targeted the older generation. 2/3 of those new shopper were Post-Family.

Chart 1

Chart 2: Haribo shoppers 2 years ago.

Chart 2 shows Haribo shoppers 2 years ago. Within Heavy Category buyers, a whopping 81% of those that had bough Haribo but weren’t loyal to the brand were post-family. Clearly this was a huge opportunity to engage with an important segment, which Haribo did successfully.

For most categories and brands Haribo’s actions really bucks the trend. Most leading brands actively target younger shoppers, and for good reason - younger shoppers are generally more willing to try new brands.

However, 38% of the UK population are over 55, 23% over 65. Although they are generally less affluent and far less likely to try new things, it’s a huge market.

But do other categories have the same opportunity that Haribo spotted? And is nostalgia the only way to crack it?

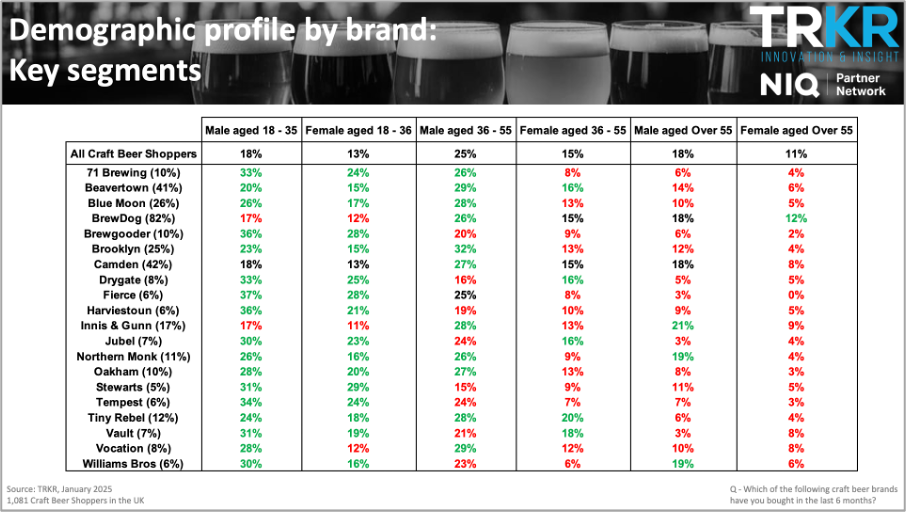

The Q1 TRKR UK Craft Beer report suggests so, with almost all brands under performing with over 55s, compared to the category average. Yet look at BrewDog.

Craft beer is a young category, yet BrewDog’s success with over 55s has come from becoming mainstream in a niche category (accounting for only 6.8% of the total beer spend Source NIQ). Other brands such as Innis & Gunn and William Bros do well with over 55s because of their bottled SKUs, sitting next to real ales.

So what?

In summary, it may not be “exciting’ but what brand would turn down the kind of success that Haribo has had with the post-children/over 55 segment?

Yet without the insight to identify (a) the opportunity, and (b) the needs of these shoppers, the opportunity would be lost

Interested in TRKR?

TRKR Ltd are a leading data and insights agency, and a connected partner of NIQ.

To receive a free copy of the reports discussed, and to discuss how data and insights can drive growth for your brand, email Director of Insights Mark Thomson at mark@trkr.co.uk.