TRKR:NIQ Brand Growth Snapshot. Chilled Convenience, October ‘25

For every brand owner, the key to unlocking brand growth is getting more shoppers to buy them, as championed by Byron Sharp in ‘How Brands Grow’

59% of the top 3,000 grocery brands have grown through penetration.

Each month our TRKR:NIQ Brand Growth Snapshot series will focus on identifying the brands that are leading the way in their respective categories. We’ll also look at what impact this has had upon their category. Have they grown by stealing spend from rival brands (creating churn) or have they added incremental growth?

With our help, FMCG brand owners will be able to look both inside and outside their categories to identify examples of growth brands they can take learnings from.

Our data is sourced from NIQ’s 30,000 GB household panel. NielsenIQ (NIQ) is the global leading consumer intelligence company, providing comprehensive market research and consumer insights. They offer detailed data on consumer behaviour, market trends, and industry performance, helping businesses make informed decisions.

TRKR work closely with the NIQ UK Small & Medium Business Team, who are passionate about providing the best data, insights and knowledge to help brands compete with the biggest players across the FMCG landscape!

Chilled Convenience is a growing category in the UK, especially driven by changing consumer habits after COVID-19. With tightening budgets and less time spent cooking, shoppers are looking for ways to enjoy restaurant-quality meals at home without hassle, as well as quick lunches on the go.

The category includes a wide range of products - from pies, rolls, pizzas, and pastas to meat-based and vegan dishes, along with cuisine-led 'Fakeaways' like British, Japanese, Indian, and Italian.

While Private Label currently leads the field, the breadth of the category provides space for brands to innovate and grow.

The key objective for Retail Buyers is finding new options that grow the category, rather than stealing from existing brands

Tesco led the category from August 2024 to 2025 with 56% of shoppers purchasing chilled convenience from the retailer, followed by Sainsbury’s and Asda.

After generating a strong buzz with its popular ‘Picky Bits’ range and the expanding chilled convenience range, M&S secured a spot in the top five.

Discounters are also seeing a growing demand, with Lidl and Aldi ranking high among the top 15 GB brands.

While the Private Label dominates the category, Ginsters stands out as the leading brand among the top 15 GB brands in chilled convenience with 27.3% of GB shoppers buying the brand in the last year

The second largest branded range in chilled convenience is Pukka Pies with 21.2% of shoppers buying their products in the past year

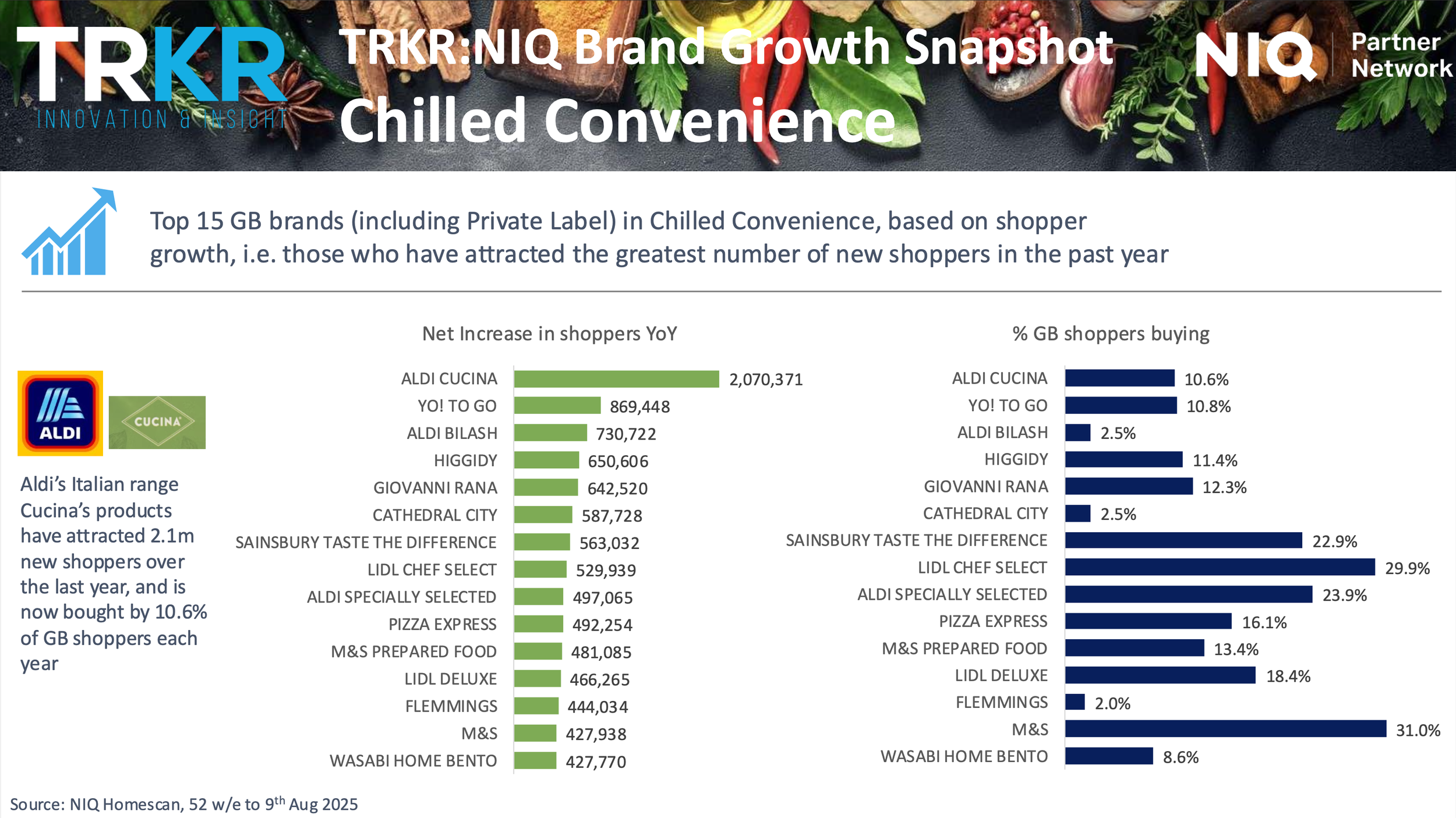

Both private label and branded products are gaining new shoppers. Aldi, Sainsbury’s, Lidl, and M&S have all grown shopper numbers with Aldi’s Cucina range leading the way.

Meanwhile, standout brands such as Yo! To Go, Higgidy, and Giovanni Rana have also seen impressive gains in shoppers over the past year.

By looking at the most successful brands in terms of penetration in the category and understanding how they achieved this, the other brands can apply these learnings to their own brands.

YO! To Go is the most successful brand in gaining new shoppers. However, almost half of this growth came from consumers switching from rival brands.

Higgidy, on the other hand, has also shown a significant growth, and 60% of this came from shoppers adding Higgidy to their existing brand repertoire, contributing to incremental sales within the Chilled Convenience category.

Similarly, Rana was successful at attracting new shoppers to their brand (+643K new shoppers). 58% of their growth was incremental to the category – driven by consumers adding Rana to their brand repertoire or attracting new customers into the chilled convenience category!

In summary….

For individual brands, growth comes from gaining new shoppers. However, for the Category and for retail buyers, success is brands achieving this by growing the category at the same time. By understanding these shopper dynamics, brand owners can focus on the best examples of incremental brand growth, which they may then try to replicate. Those brands will be more likely to retain and grow shelf presence and distribution.

What next?

We (you) can use NIQ’s Panel data to identify what is driving the growth (or decline) of your own brand and products, and of rival brands in your category.

In addition to switching and incremental sales, other useful measures within Panel include:

Penetration - the % of GB households who are buying a brand over a given time period

Shopper conversion - for example, the % of Sainsbury’s Chilled Convenience shoppers who are buying Ginsters

Spend per household - the average spend on a category/sector/brand (or in any retailer) over a given time period

TRKR have years of experience in combining Panel data with EPOS data and bespoke shopper insight, to create compelling Retail Buyer pitches for our clients. Not just in Chilled Convenience, but across most FMCG categories.

We offer suppliers a free 60-minute category management training session, individually or as a team, where our Insight Director Mark Thomson shares his experience to help you optimize your retailer packs by getting the most from your EPOS and Panel data and leveraging bespoke insights.

Book your session now!